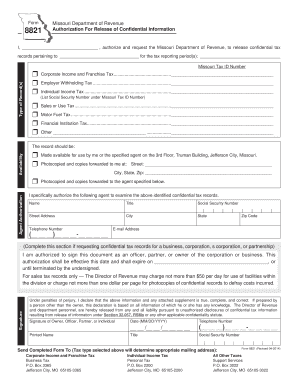

MO Form 8821 2014-2026 free printable template

Show details

The Director of Revenue and department personnel are hereby released from any and all liability pursuant to unauthorized disclosures of confidential tax information resulting from release of information under Section 32. 057 RSMo or any other applicable confidentiality statute. Signature of Owner Officer Partner or Individual Date MM/DD/YYYY / / Printed Name Send Completed Form To Tax type selected above will determine appropriate mailing addre...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 8821

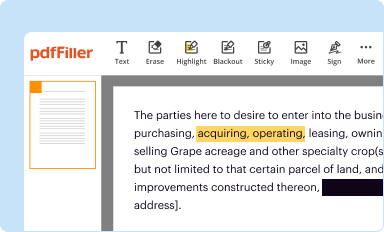

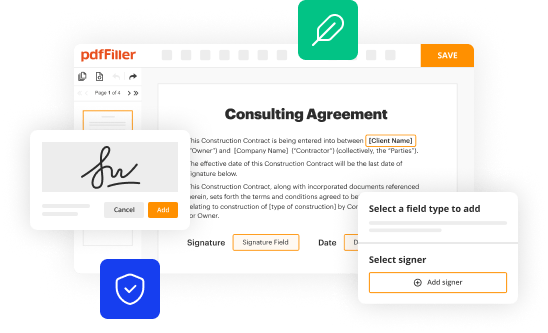

Edit your business form 8821 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

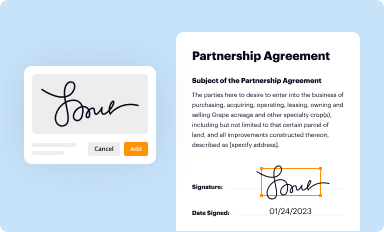

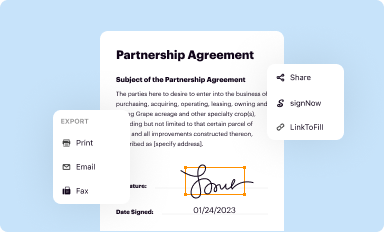

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO Form 8821 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MO Form 8821 online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MO Form 8821. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO Form 8821 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO Form 8821

How to fill out MO Form 8821

01

Obtain the MO Form 8821 from the Missouri Department of Revenue website or your local tax office.

02

Fill out your personal information at the top of the form, including your name, address, and Social Security number or taxpayer ID.

03

Indicate the type of tax information you are requesting by choosing the appropriate sections on the form.

04

Specify the tax years or periods for which you want the information.

05

Complete the authorization section by providing the name, address, and tax identification number of the person or organization you are authorizing to receive your tax information.

06

Sign and date the form to validate your request.

07

Submit the completed form to the Missouri Department of Revenue via mail or any designated submission method.

Who needs MO Form 8821?

01

Any individual or entity who requires access to their or another person's tax information for purposes such as financial aid, mortgage applications, or personal record-keeping.

Fill

form

: Try Risk Free

People Also Ask about

Can I download and print tax forms?

You can e-file directly to the IRS and download or print a copy of your tax return.

Can I print tax forms off the Internet?

Can I Print Tax Forms Online? Yes, you can print the tax forms you download for free from the IRS website. You can also print forms from other sites that offer free downloads. If you use an online filing software, you can usually print the forms after you use the software to complete all the information.

At what age do seniors stop paying property taxes in Missouri?

State of Missouri: Department of Revenue (573) 751-4450. Automated Tax Credit Status. (573) 526-8299. Property Tax Credit Claim. (573) 751-3505.

What are Missouri revenue taxes?

Missouri has a 4.0 percent corporate income tax rate. Missouri has a 4.225 percent state sales tax rate, a max local sales tax rate of 5.763 percent, an average combined state and local sales tax rate of 8.33 percent. Missouri's tax system ranks 11th overall on our 2022 State Business Tax Climate Index.

Why am I getting a letter from Missouri Department of Revenue?

Understanding Your Notice You received this notice for one of the following reasons: The Internal Revenue Service (IRS) provided information to the Department indicating your federal return was filed with a Missouri address and a Missouri return was not filed.

What does Missouri Department of Revenue do?

Contact your County Assessor's Office. For contact information, see the Missouri State Tax Commission website.

How do I get a PIN number for the Missouri Department of Revenue?

Your identification number is the 8 digit number issued to you by the Missouri Department of Revenue to file your business taxes and is included on your sales tax license. Your PIN is a 4 digit number located on the cover of your voucher booklet or return.

How do I contact the Missouri Department of Revenue sales tax?

Contact the Missouri Department of Revenue or call 573-751-9268, for assistance.

How do I set up a Missouri Department of Revenue account?

Create a MyTax Missouri Account Please accept the MyTax Missouri usage terms to register for a portal account. You will need to provide your First and Last Name, Phone Number, and e-mail address to create a user ID for the Missouri Department of Revenue's MyTax Missouri.

Can I pay Missouri Department of Revenue online?

Paying Online The Missouri Department of Revenue accepts online payments — including extension and estimated tax payments — using a credit card or eCheck. An eCheck is an easy and secure method to pay your individual income taxes by electronic bank draft.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get MO Form 8821?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific MO Form 8821 and other forms. Find the template you need and change it using powerful tools.

How do I complete MO Form 8821 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your MO Form 8821. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I complete MO Form 8821 on an Android device?

Use the pdfFiller app for Android to finish your MO Form 8821. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is MO Form 8821?

MO Form 8821 is an authorization form used in Missouri allowing an individual to designate someone to receive their tax information from the Missouri Department of Revenue.

Who is required to file MO Form 8821?

Individuals who wish to authorize someone else to access their tax information must file MO Form 8821.

How to fill out MO Form 8821?

To fill out MO Form 8821, you need to provide your personal information, specify the authorized representative’s details, and sign the form to consent.

What is the purpose of MO Form 8821?

The purpose of MO Form 8821 is to allow taxpayers to appoint someone else to receive tax information, facilitating communication with the Missouri Department of Revenue.

What information must be reported on MO Form 8821?

MO Form 8821 requires you to report your name, address, Social Security number, the name and contact information of the authorized representative, and the specific tax matters for which the authorization applies.

Fill out your MO Form 8821 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO Form 8821 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.